A White Paper by Col Michael W. “Starbaby” Pietrucha

The views expressed are those of the author and do not necessarily reflect the official policy or position of the Department of the Air Force or the US Government.

This is the first of a series of three papers intended to create a framework for a credible, affordable warfighting strategy against China. The second paper, Reinventing the Cartwheel, lays out a deliberate strategic interdiction strategy while the third, Airpower and Strategic Interdiction, discusses the impact on USAF force structure and capability design.

The lessons from the Gulf War are neither necessarily universal nor applicable in other conflicts.

Dr. Donald D. Chipman[i]

Military organizations are often accused of fighting the last war. In the case of the US Air Force, the war in question is DESERT STORM, the last unambiguous US victory and a major milestone in the development of airpower. The Gulf War was a major success for airpower, demonstrating effective applications of stealth, precision, and electronic warfare. But the war was fought with overwhelming logistical, numerical and technological superiority against an adversary that was geographically isolated, poorly trained, badly equipped and ineptly led. It is unlikely that we will operate from such a position of advantage again. DoD planners should give up on the fantasy of a short, decisive war against the People’s Republic of China – any short decisive war involving the PRC is likely to end in a PRC victory.

The lessons from the Gulf War should be applied to future conflicts with caution, especially if the adversary is China. In a potential conflict with China, it is the US that is geographically and numerically disadvantaged, and Chinese military development for the past two decades has been organized around one key principle – that the US would not be allowed to repeat DESERT STORM. The DoD summarizes the Chinese approach under an “anti-access, area denial” (A2AD) label, but is overly focused on finding technological means to operate in the A2AD environment in order to attempt a repeat of the Gulf War’s air campaign. China is perhaps the least likely country to succumb to such a strategy, which is an attempt to match strength against strength in an epic, mano-a-mano battle where China holds advantages in distance and mass that we are unlikely to ever overcome conventionally. If the Air Force is going to do its part in deterring the PRC, we must contribute to a viable offset strategy that relies as much on geography as technology.

This is not to say that the PRC cannot effectively be fought, only that we cannot do so with a replay of techniques that proved successful over two decades ago over Iraq. It is to say that we are turning to the wrong war for our example. The war we should be basing our upon strategy is another conflict in which we fought an island nation that had successfully executed an “A2AD” strategy by physically occupying much of the Asian landmass from Manchuria to Burma to Wake and the Solomons. The example we are looking for, and should be planning to, is the Pacific War from 1941 to 1945. An analysis of the flow of goods and materials into and out of China reveals that with 98% of all freight moving by sea, China is practically, if not geographically, an island nation. As such, it is vulnerable to interdiction of trade routes to a far greater degree than a land power, and this is a national vulnerability that airpower is well-positioned to exploit – if applied properly.

Background

The Pacific War against Japan was not a quick war. Excepting the very end, it had no “shock and awe” component. It was a grinding advance across limited real estate to approach the Japanese home islands from the south while maintaining pressure on other fronts, including the interior of China, New Guinea and the Philippines, India and Burma. Fundamentally, it was a series of campaigns focused on establishing a logistical chain for Allied forces that would allow the application of airpower against Japan until such time as a massive amphibious assault could be undertaken or the home islands could be starved into submission. Equally important, it was a sustained counter-logistics campaign conducted against an island nation occupying island territory across the theater.

The US executed a sustained maritime interdiction campaign beginning at the outset of the war. Admittedly, it was the only option available to the US Navy, but also one that had received a great deal of thought prior to the outbreak of war. The submarine war against Japan began immediately after the attack on Pearl Harbor – Admiral Hart, commander of the Asiatic Fleet, authorized unrestricted submarine warfare before the Japanese second wave had recovered aboard their carriers.[ii] While airpower accounted for more warships, submarines and mine warfare accounted for the majority of the Japanese merchant marine, sinking 1360 of the 2,117 large merchant ships sunk by US forces.[1] Despite the fact that Japan impressed captured ships into service, their merchant marine shrunk continuously during the war because of relentless Allied attack. Eventually, the Japanese merchant fleet was unable to perform its most basic functions; it could not replenish forward naval forces, move resources to Japan, supply outposts, or evacuate forces that could not be resupplied.

The maritime interdiction campaign was essentially Joint a campaign intended to gain effects in what we would characterize today as an A2AD environment. Land-based air was the major source of airpower in the west, while carrier-based air supported successive island-hopping campaigns beginning in November 1943. Fifth Air Force’s (5AF) first responsibility was to gain control of the air, which entailed substantive offensive and defensive components with limited fighter resources. In 1942, 5AF bombers spent the majority of their time conducting logistics and counter-logistics, attacking Japanese maritime traffic, ports, airfields, and oil refineries. In their efforts to prevent the Japanese from reinforcing their forces in New Guinea, 5AF routinely attacked anything that moved on the water. While merchant ships loss statistics tell some of the story, they do not tell all of it. The official statistics only count ships of 500 tons displacement or greater used for long-haul routes. Short haul supply was supplemented by small watercraft of less than 500 tons displacement, commonly referred to as “barges”. 5AF in particular attacked watercraft during the day, from locally-built barges to tramp steamers and small warships, sinking them quite literally in the hundreds. In sea areas beyond the routine reach of aircraft and in joint attack areas by night, the naval interdiction effort was undertaken by PT Boats and submarines, ensuring constant pressure. By November 1942, Japanese Naval Forces in and around the Solomons ceased all offensive operations and light forces were dedicated almost entirely to resupply. By May of 1943, the Imperial Japanese Navy’s defensive perimeter did not enclose New Guinea, which was abandoned.[iii] Japanese deaths on New Guinea alone exceeded 148,000, the vast majority through disease and starvation.[iv] From November 1942 until the end of the war, 5AF claimed to have sunk 1.75 million tons of enemy shipping, excluding barges and similar small craft.[v]

In the home islands, the effects of maritime interdiction were substantial. In 1941, Japan’s economic development was a fairly recent event. Japan began orienting the economy towards war in 1928, multiplying its heavy industrial production by 500% by 1940. The primary limitation on Japanese industry was the import of raw materials, including and especially oil, ferro-alloys, and nonferrous metals. They established strategic reserves in bauxite and oil.[vi] But attacks on shipping reduced the Japanese industrial base far below capacity. The economy was designed for a short, sharp war at the end of which the Japanese economy would have retained access to resources. Japan’s economy not structured or resourced for a long war against an industrial power. By 1943, oil was being successfully interdicted in part, and the flow of oil from the Dutch East Indies completely halted in April 1945.

It is the opinion of the Survey that by August 1945, even without direct air attack on her cities and industries, the over-all level of Japanese war production would have declined below the peak levels of 1944 by 40 to 50 percent solely as a result of the interdiction of overseas imports… Even though the urban area attacks and attacks on specific industrial plants contributed a substantial percentage to the over-all decline in Japan’s economy, in many segments of that economy their effects were duplicative. Most of the oil refineries were out of oil, the alumina plants out of bauxite, the steel mills lacking in ore and coke, and the munitions plants low in steel and aluminum. Japan’s economy was in large measure being destroyed twice over, once by cutting off of imports, and secondly by air attack.[vii]

The successful interdiction of the Indies did not completely shut off the flow of materials to Japan. Manchuria provided iron, coking coal (for steel), salt, bauxite and arable land (for food production), but did not provide significant sources of petroleum. Taiwan, a Japanese territory since 1895, provided resources including petroleum, but not nearly in sufficient quantities for wartime Japan. Even the Japanese investment in synthetic fuel production was centered offshore in China and Manchuria, and by 1944 the Japanese had reached their peak production, with 15 plants producing 717,000 barrels of oil.[viii] Combined with domestic production in 1944 of 1.6 million barrels from Japanese home islands, essentially only 9% of the annual oil demand was not subject to maritime interdiction.[ix]

Japanese oil inventories in thousands of barrels[x]

| Fiscal Year | Crude Petroleum | Refined Products | Starting Inventories | Consump-tion | ||||||

| Imports | Production | Total | Imports | Production | Total | Crude | Refined | Total | ||

| 1941 | 3,130 | 1,941 | 5,071 | 5,242 | 15,997 | 21,239 | 20,857 | 28,036 | 48,893 | 36,974 |

| 1942 | 8,146 | 1,690 | 9,836 | 2.378 | 16,674 | 19,052 | 12,346 | 25,883 | 38,229 | 41,790 |

| 1943 | 9,848 | 1,814 | 11,662 | 4,652 | 16,167 | 20,819 | 6,839 | 18,488 | 25,327 | 43,992 |

| 1944 | 1,641 | 1,585 | 3,226 | 3,334 | 9,615 | 12,949 | 2,354 | 11,462 | 13,816 | 25,045 |

| 1945 (first half) | 0 | 809 | 809 | 0 | 1,933 | 1,933 | 195 | 4,751 | 4,946 | ~6,576 |

For the majority of the war, the short water route across from Korea to Japan was not interdicted. The Sea of Japan had proven a particularly difficult operating area for submarines, and it was not within reach of US aircraft. After USS Wahoo was declared lost in November of 1943, no US sub re-entered the Sea of Japan until June of 1945. But in March of 1945, Tinian-based B-29s began the largest aerial mining effort in history, codenamed operation STARVATION. The operation was intended to close the Shimonoseki Strait (also called the Kanmon Straits), blockade Tokyo and Nagoya in the adjacent inland sea, and mine ports in Korea and the northern Japanese coast. At the time, the Straits were the key maritime chokepoint, with 80% of Japan’s maritime traffic passing through.[xi] Total monthly traffic consisted of 1.25 million tons of shipping, consisting of 20-30 ships above 500 tons and 100-200 ships below 500 tons.[xii] STARVATION effectively shut down maritime traffic in targeted areas, accounting for more ships damaged or sunk during the last six months of the war than all other sources over the entire Pacific Theater combined.[xiii]

The efforts to deprive Japan of needed resources were long-running and widespread. The mix of submarines, carrier aviation, and land-based airpower was an effective combination for conducting an extensive campaign at long ranges in spite of enemy defenses and a lack of local basing for Allied airpower. Despite plans for an invasion of the Japanese home islands, many senior airmen felt that Japan could be driven to surrender by a combination of maritime blockade and strategic bombing.[xiv] In any event, the use of Atomic weapons forced a rapid surrender and ended the debate. Nevertheless, it is clear that absent any direct attack on the home islands by any means, the maritime interdiction campaign had successfully brought Japan to the brink of surrender. Like any island nation, Japan was uniquely vulnerable to the interruption of sea traffic.

China: The Island Nation

We do not think of China as an island nation. After all, it has almost double the land border of the United States – 11958 nm – and borders 13 independent countries. But the land transportation links over these borders are extremely limited. The border terrain is unfavorable, dominated by desert, steppes, mountains (including the Himalayas) and jungle. Border disputes with several countries, including Bhutan, India and Pakistan, have delayed or prevented development of transportation infrastructure along the PRC borders.

The total number of border “ports” along the Chinese Border stands at 90, counting the newest connection to the Afghanistan border but excluding airports. The capacity compares unfavorably with the 119 border crossings between the US and Canada alone.[xv] The comparison is inherently unbalanced, in that the Chinese border is relatively undeveloped, while the US-Canadian border has benefitted from more than two centuries of continuous expansion. The US and Canadian road and rail networks are effectively linked, whereas Chinese railroads do not even share the same gauge (track width) as any of their neighbors excepting Mongolia and North Korea, and sometimes not even then. Continuous rail lines extend only into Russia, Kazakhstan, North Korea or Vietnam, requiring either bogie exchange or cargo crossloading wherever there is a gauge change.[2] The total cross-border cargo carried by rail in 2012 was 54.24 million tonnes, with another 64.9 million tonnes[3] moved by truck.[xvi] This is a fraction of comparable US overland trade in that same year, where the rail systems moved 139 million tonnes with trucks moving 177 million tonnes.[xvii] Roughly a fifth (19 million tonnes in 2012[xviii]) of the PRC’s import flow by rail is coal mined in Mongolia.

There are only five long-haul rail lines crossing the border at all, three crossing from Siberia and two from Kazakhstan, and those lines carry more exports than imports. The primary reason for the expansion of the PRC’s rail crossings in the last five years has been to carry exports to markets rather than to import goods or resources. The fifth line, Hunchun, has been closed for most of the last 15 years, but reopened in late 2013 and in 2014 moved comparatively little rail traffic, mostly coal.

While the border crossings have been expanded and upgraded in the last five years, they are limited in capacity by the infrastructure on both sides of the border. All five lines are much more limited than their US counterparts, because they tend not to be double tracked (less than half of China’s rail lines are double-tracked)[xix] and do not have the high height limits of US trains, which can double-stack containers. The comparable road systems are also substantially less developed, with long distances between markets and much more limited capacity than the US interstate system. Also unlike the US, China’s international land ports are concentrated in five locations, all rail and road-served.

| Port | Country | 2012 traffic (metric tonnes) |

| Horgos | Kazakhstan | 22,000,000[xxi] |

| Dostyk | Kazakhstan | 15,000,000[xxii] |

| Hunchun | Russia | 0 (600,000 in 2014)[xxiii] |

| Manzhouli | Russia | 30,060,000[xxiv] |

| Suifenhe | Russia | 8,000,000[xxv] |

Table 1: 2012 Traffic through the five major PRC border ports with rail freight

Table 2 shows the total cross-border cargo movement traffic for 2012, which includes river, road and rail traffic. Air traffic and petroleum pipelines are not included. Notably, there were no exploitable land routes to Afghanistan (even now, the road only goes to the PRC side of the border) or Bhutan, which does not even have diplomatic relations with China. Despite the fact that China is India’s largest trading partner, the countries do not exchange goods across their disputed border.

| Country | Ports Number | Foreign trade cargo (1000 tonnes) | Percent (%) |

| Kazakhstan | 9 | 40,884 | 33.6 |

| Mongolia | 13 | 34,851 | 28.6 |

| Russia | 23 | 31,783 | 26.1 |

| Vietnam | 10 | 4655 | 3.8 |

| Burma | 5 | 3621 | 3.0 |

| North Korea | 15 | 3513 | 2.9 |

| Kyrgyzstan | 2 | 1048 | 0.9 |

| Laos | 4 | 1005 | 0.8 |

| Tajikistan | 1 | 173 | 0.1 |

| Nepal | 4 | 174 | 0.1 |

| Pakistan | 1 | 59 | 0.0 |

| Afghanistan | 0 | 0 | 0.0 |

| Bhutan | 0 | 0 | 0.0 |

| India | 0 | 0 | 0.0 |

| TOTAL | 87 | 121,766 |

Table 2: Overland foreign trade cargo in 2012[xxvi]

China has three international oil pipelines, crossing from Russia, Kazakhstan and Burma. The total capacity is advertised as 980,000 barrels per day, but this number is deceptive. The largest capacity pipeline, through Burma, has yet to move more than test quantities of oil, although it has been moving natural gas. The Sino-Burmese oil pipeline is limited by the fact that while the pipeline exists, the oil has nowhere to go once it reached the Chinese terminus in Kunming. The refinery that was supposed to be built in Kunming hasn’t broken ground as of this writing and there are no internal oil pipelines from Kunming to elsewhere in China.

The Energy Sector[4]

China is not entirely self-sufficient in any of the non-renewable energy sources that it uses to provide electricity and transportation. As a result, China has two key vulnerabilities on the energy front. The first is the distribution network within country, which is highly energy-intensive, and largely dependent on oil. This ties together with electricity generation, in that China’s power generation capacity is mostly coal-dependent, and coal is dependent on surface transport for distribution. For 2013, coal provided 65% of China’s energy consumption, which has been a relatively constant figure for the last decade.[xxvii] China meets 96% of its coal demand domestically, meaning that effective coal interdiction would have to be accomplished by affecting the domestic transportation network. Chinese coal imports tend towards coking coal for industrial processes, versus steam coal for power generation.

Figure 2: China’s Energy Infrastructure. Crude oil pipelines are in green (orange if international), and oil product pipelines are blue. Refineries (gas pumps) that produce jet fuel are red, with orange producing jet fuel components. Green refineries mostly produce chemicals and no fuel. Oil terminals are green ships, green and purple circles are the SPR sites, and the rail network is in red. No teakettle refineries or province borders are displayed.

The second vulnerability is that the PRC imports the majority of its petroleum, and the maritime petroleum transport network involves long distance movement that the PRC cannot possibly protect. As of 2014, China is the world’s second largest oil importer, approaching the US. Throughout 2014, China averaged 6.2 million barrels per day (bpd), compared to 7.4 million bpd for the US. However, in February 2015, China’s oil imports spiked at an average rate of 7.53 million bpd, exceeding the US for the month. Driven in part by low oil prices, China is assessed to be filling strategic reserves while prices are low, maintaining at least a 30-day supply of imported oil (and probably closer to 100 days).[xxviii]

As with coal, China’s demand exceeds domestic production, but China imports much more oil, approaching 60% of its total requirement. Petroleum import data alone gives an incomplete picture of China’s fuel requirements. Crude oil is simply sticky black goo with very little utility in its unrefined state. Refining is necessary to turn that goo into useable fuels. In 2013, China’s total refining capacity was 12.6 million bpd, behind only the US at 17.8 million bpd and representing a comfortable overcapacity of about 24%.[xxix] The output of China’s refineries has typically focused on lighter distillates, tending towards diesel fuel and gasoline, which allowed China to become a net diesel fuel exporter in 2012. In 2014, driven by a strong market, Chinese major refineries switched to the more profitable middle distillates (naphtha, kerosene and jet fuel), becoming a net jet fuel/kerosene exporter and reversing a trend that had seen China as Asia’s largest jet fuel importer only a year earlier.[xxx] This occurred despite the fact that China’s smaller, private “teakettle” refineries, which account for a quarter of the nation’s refinery capacity, produce no jet fuel components at all.[xxxi]

Overall, China’s expansion of its refinery capability within the past four years has left the PRC able to meet 98% of its demand for petroleum distillates, and capable of having a net export balance for all distillate fuels except naphtha.[xxxii] China’s vulnerability to supply interdiction is largely limited to crude oil, although as naphtha is a key ingredient for jet fuel, this remaining import dependency is still significant.

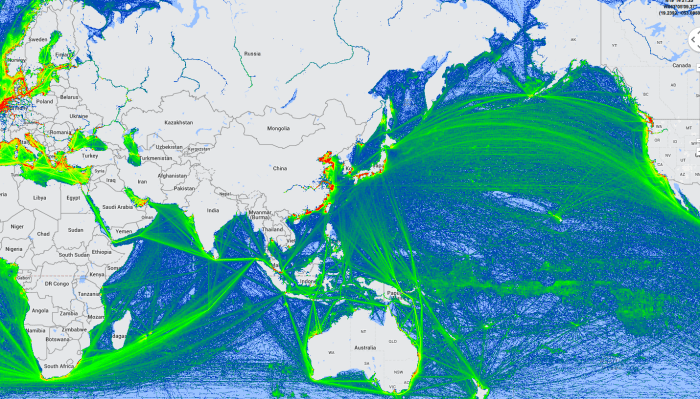

Maritime Dependency

By comparison to trade across land borders, China’s sea trade is massive. Using figures from only the top 15 coastal ports, the volume of seaborne trade in 2013 came to 7.28 billion tonnes, up from 6.65 billion tonnes in 2012[xxxiii]. Using 2012 figures, this means that international road and rail trade comes to less than 1.8% of the volume of freight transported by sea; that disparity is likely to have increased in 2013 and 2014 as the amount of seaborne trade is increasing at a faster rate than any other transport mode in both relative and absolute terms. Put another way, the annual movement of freight through all of China’s international borders is matched in under 60 days by Shanghai’s port complex alone.[xxxiv] There is no conceivable condition under which China’s land trade routes could mitigate a maritime interdiction campaign.

The huge disparity between land and sea trade is likely to continue to increase. Overland trade is infrastructure-limited, and depends heavily on road and rail infrastructure in neighboring countries. Russia’s pipeline and rail infrastructure in Siberia has to serve multiple customers, including Russia itself, Japan, and Korea. With sea trade essentially a global phenomenon, the infrastructure is well-established and continuing to expand worldwide, without intermediate bottlenecks.

For China, this means that this trade flow is subject to interdiction. China’s power projection capability is limited, and the maritime geography is strategically unfavorable. The first and second island chains hem in China, putting it in a position where all of its maritime trade must pass through waterways that can be controlled (or at least denied) by foreign powers. China’s maritime trade generally passes through a number of chokepoints, most especially the Straits of Malacca.

Overland transport of oil via pipeline and rail accounts for less than 10% of all oil imports, and this only from Russia and Kazakhstan. Even Russia relies on maritime transport for oil; in 2014, 55% of the oil imported from Russia went by sea rather than pipeline or rail.[xxxv] Looking at the rest of the totals, it’s clear that around 85% of the oil imported into China passes through the Straits of Malacca (77%) or the Panama Canal (8%). Around fifty percent of the PRC’s oil imports pass through two chokepoints rather than just one – the Straits of Hormuz, the Panama Canal or Bab al Mandar as well as Malacca.

The limits on the Straits of Malacca have a real impact on ship design, as ships too long or deep for the narrow passageway have to detour around Indonesia and sail through the Lombok Strait. Tanker sizes have actually shrunk since the 1970s partly because of this; “Malaccamax” designs are the largest ships able to transit the Straits of Malacca, and are classed a Very Large Crude Carriers (VLCCs). A typical VLCC can carry two million barrels of oil, but is reliant on offshore terminals or smaller tankers for loading and offloading. A single VLCC carries about four days maximum flow for the Siberian and Kazakh pipelines combined. Eleven to fifteen of these vessels pass through Malacca daily, in both directions.

From a military standpoint, the majority of maritime trade is irrelevant. Container ships, which are used to move commercial goods, constitute the majority of the maritime traffic and are not militarily relevant except for spare parts and system components. Similarly, while China imports vast quantities of raw materials (particularly iron), domestic production of most raw materials such as metal ores, minerals, rare earths and potash is among the top three global producers, depending on the year.[xxxvi] In the 1930s, Japanese military expansion looked towards China’s resources as a solution to Japan’s natural resource shortages, recognizing that China is comparatively resource-rich. While China cannot fuel its industrial machine with domestic products alone, it has the capacity to maintain its military industry almost entirely with domestic supplies of raw materials.

China’s vulnerability is related to the fact that while its resources are large, the country’s massive consumption exceeds the capability of domestic resource production. Nowhere is this more apparent than in the energy sector, where Chinese demand for coal, petroleum and natural gas is satiated only through foreign imports. Indeed, it is these energy imports that could provide a key degree of leverage on the military front. The energy supply from overseas powers all of China’s power projection capabilities, along with the industries that produce it and the transportation network that supplies and moves it.

Implications

The vast majority of seaborne imports come from well outside the capability of the PLAAF or PLAN to effectively protect. Unlike Japan and South Korea, which could reasonably expect to maintain northern supply routes to Alaska against Chinese opposition, the Chinese have no such geographical advantage or supporting alliance structure.

Moreover, in any conflict with China, the US would start in a much more favorable position than it did against Japan in 1941. We have more combat power forward, our partners are nations in their own right and not poorly defended colonial outposts, and this time we are not opposing a Japan that has already expanded. China today cannot yet compare with Imperial Japan for amphibious sealift and will not have a decade-long running start on territorial expansion on the Asian Mainland. Certainly, our forward basing posture leaves US forces subject to direct attack from the PRC proper, but the islands which host our facilities are not under the threat of occupation.

The unfavorable maritime geography and dependency on overseas trade leaves China vulnerable to a Strategic Interdiction strategy – a Joint effort designed to prevent the movement of resources related to military forces or operations. While a deeper discussion of Strategic Interdiction is a subject for a follow-on paper, an overview of such a strategy can be outlined and applied to China.

In contrast with maritime interdiction, Strategic Interdiction (SI) is not a broad blockade but is a targeted effort to interdict primarily the production and transport of energy resources. A campaign would have four elements:

- A “Counterforce” effort designed to attrit the adversary air forces (particularly bombers), naval forces (gray hulls) and naval auxiliaries (replenishment) to the point where they can neither project military power nor defend against US power projection, at least far beyond the PRC continental shelf.[5]

- An “Inshore” element, which consists of operations to deny effective use of home waters, including rivers and coastal waters. Standoff or covert aerial mining is a key component of this element.

- An “Infrastructure Degradation” plan intended to disrupt or destroy specific soft targets, such as oil terminals, oil refineries, pipelines and railway chokepoints such as tunnels and bridges. Many of these targets would be in airspace not defended by ground-based air defense.

- A “Distant” maritime strategy, which occurs out of effective adversary military reach, intended to interdict energy supplies. This strategy is aimed primarily at bulk petroleum carriers (tankers) and secondarily at coal transports, and not at container, dry bulk, or passenger vessels. Such a strategy might not be lethally oriented, directed instead towards the seizure and internment of PRC-bound vessels.

A strategic interdiction campaign is fundamentally a logistically based strategy. The primary objective is to effectively neutralize certain elements of PRC military power by starving them of energy. In effect, this strategy targets naval and air forces, which rely on jet fuel, and leaves the gasoline and diesel-dependent army to compete with domestic fuel needs – because without the PLAAF and the PLAN, the PLA doesn’t ever leave the mainland. The primary targets are air and naval forces, but they are affected by an indirect route that is difficult to counter over the medium to long term. Much has been said, with respect to PRC missile forces, that the objective is to “shoot the archer”, the implication being that such an action would prevent the archer from launching standoff weapons against air or surface targets. An SI campaign is designed to starve the archer, the guys who protect the archer, the folks who make, carry and deliver the arrows, and the people who brought the archer to the battlefield in the first place. A complete campaign design would take advantage of the relationship between energy and infrastructure to disrupt a slice of the energy web in as many places as possible.

Such a strategy is inherently asymmetric for the US, in that it cannot succeed against our mainland. Our maritime geography is extremely favorable, with four coasts that are difficult to interdict, two of which are not adjacent to the Pacific. The power projection capability required to conduct a maritime interdiction campaign against the US is well outside any projected PLAN capability. The strategy also takes advantage of the US advantage on blue-water naval capabilities and long-range strike aircraft. Indeed, the US airpower advantage is critical to any interdiction campaign, just as it was in World War II.

Wrapup

Against the USSR, the United States elected not to undertake an approach that was intended to directly offset the Soviet advantage in numbers and the vulnerabilities of Europe to a ground invasion. Instead, it adopted offset strategies to asymmetrically counter the USSR’s strengths, leading to both tactical nuclear weapons and a revolution in precision munitions and sensors. A quarter century after the fall of the wall, it is perhaps time to adopt a third offset strategy aimed squarely at the PRC.

For more than two decades, the standing USAF template for applying combat airpower against a target country has been the DESERT STORM model. While this model may still have some applicability, it is long past time to abandon it for a conflict against a peer or near-peer nation. DESERT STORM was conducted against an adversary that was surrounded by enemies, outnumbered, technologically outmatched, and attacked by a force that had unlimited local basing, was better trained, better led, and better equipped. None of those conditions will apply in a conflict with China, where we are likely to have parity in a number of these areas, a slight degree of superiority in others, and a critical disadvantage in basing, numbers, and magazine depth. It makes no sense to attempt to enter a fight on Chinese terms, in their own front yard, against a massive opponent who has historically demonstrated the ability to take a great number of punches on home ground and still stay in the fight.

The key to a successful strategy then is to not to attempt to apply a template leftover from when we had all of the cards, but to maximize the potential of the cards that we do have; long range aviation, advanced naval forces, and a combat-experienced enterprise and match them against China’s import vulnerabilities, long sea lines of communication, energy requirements and unfavorable maritime geography. With this particular set of opposing conditions, the obvious strategy template is derived from our Pacific War experience from 1941 to 1945. If we are going to fight a previous war to fight, we should pick the one appropriate to the conditions.

[1] This data includes only ships over 500 tons deadweight tonnage (DWT). Joint Army-Navy Assessment Committee, Summaries of Japanese Shipping Losses, Table III, http://www.ibiblio.org/hyperwar/Japan/IJN/JANAC-Losses/JANAC-Losses-2.html.

[2] A bogie exchange is a process where rail cars are lifted off their wheels (bogies) and have the bogies replaced with ones of the proper gauge. Locomotives do not change gauge; each nation must have their own locomotives and drivers at the border.

[3] The PRC uses the metric system, and thus “tonnes” is used to designate metric tons rather than the short tons used in US freight statistics..

[4] A great deal of the data on Chinese economy, including energy and freight data, is supplied either by the PRC government or state-owned companies. It is therefore suspect, in that all subordinate echelons are incentivized to report numbers that indicate growth. It seems likely though that the figures likely represent an inflated capability rather than a diminished one, and therefore be suitable for this analysis. An attempt was made to draw data from 2011 or later; publication of Chinese economic data typically lags by one to three years.

[5] Because of the density and capability of PRC ground-based air defenses (GBAD), counterforce in this context does not include OCA or interdiction efforts on or over the mainland.

[i] Dr. Chipman, Donald D. Airpower: A New Way of Warfare (Sea Control), Airpower Journal – Fall 1997

[ii] Holwitt, Joel Ira. Execute against Japan: The U.S. Decision to Conduct Unrestricted Submarine Warfare. Ohio State University, 2005, Pg 141

[iii] Stevens, David. Journal of the Australian War Memorial: The Naval Campaigns for New Guinea, https://www.awm.gov.au/journal/j34/stevens.asp

[iv] Sandler, Stanley. World War II in the Pacific Encyclopedia, 754 Garland Publishing, NY, 2001, Pg 754

[v] United States Strategic Bombing Survey (USSBS), The 5th Air Force in the War Against Japan, US Government Printing Office, Washington DC. June 1947, Table 26

[vi] United States Strategic Bombing Survey: Summary Report (Pacific War), US Government Printing Office, Washington DC. Pg 13-14

[vii] Ibid. Pg 15

[viii] Stranges, Anthony A. “Synthetic Fuel Production in Prewar and World War II Japan: A Case Study in Technological Failure”, Annals of Science, 1993.

[ix] Horowitz, Manny. “Were there strategic oil targets in Japan in 1945?” Airpower History, Volume 51, Number 1, Air Force Historical Foundation, Andrews AFB, Spring 2004.

[x] Cohen, Jerome B. Japan’s Economy in War and Reconstruction. Minneapolis: University of Minneapolis Press, 1949.

[xi] CAPT Mason, Gerald A. Operation Starvation, Maxwell AFB, February 2002

[xii] USSBS, Interrogations of Japanese Officials (vol. 1), US Government Printing Office, Washington DC. 1946. Pg 257

[xiii] Maj Chilstrom, John S. Mines Away: The Significance of US Army Air Forces Minelaying in World War II, Air University Press, Maxwell AFB, 1993

[xiv] Mason.

[xv] CBC News, “The Canada-U.S. Border: By the Numbers”. 7 December 2011. http://www.cbc.ca/news/canada/the-canada-u-s-border-by-the-numbers-1.999207 (accessed 7 March 2015)

[xvi] Jiaoe Wang, Yang Cheng and Huihui Mo, “The Spatio-Temporal Distribution and Development Modes of Border Ports in China”, Sustainability 2014, 6(10), 7089-7106; at http://www.mdpi.com/2071-1050/6/10/7089/htm (accessed on 7 March 2015)

[xvii] US Department of Transportation, Freight Facts and Figures 2013, Table 2-9, http://www.ops.fhwa.dot.gov/freight/freight_analysis/nat_freight_stats/docs/13factsfigures/pdfs/fff2013_highres.pdf, converted to metric (Accessed 7 March 2015)

[xviii] Huo, Harry (ed.). “A study of the China-Mongolia coking coal trade”. 29 January 2013, http://en.sxcoal.com/85003/NewsShow.html (Accessed 7 March 2015)

[xix] National Bureau of Statistics of China, Table 18-5 Quality of Transport Routes, China Statistical Yearbook 2014, http://www.stats.gov.cn/tjsj/ndsj/2014/indexeh.htm (accessed 11 March 2015)

[xx] Jiaoe Wang, et al.

[xxi] Cui Jia and Gao Bo, New Xinjiang border city of Horgos gets green light, China Daily USA, 7 Dec 2014, http://usa.chinadaily.com.cn/epaper/2014-07/12/content_17767661.htm (accessed 8 march 2015)

[xxii] Central Asia Times, “Sino-Kazakh Ties on a Roll,” Jan 24 2013, http://atimes.com/atimes/Central_Asia/OA24Ag01.html (accessed 8 March 2015)

[xxiii] Wei, Liao. “Hunchun-Makharino railway becomes major artery of China-Russia trade exchange”, 23 December 2014, http://www.ejilin.gov.cn/2014-12/23/content_19151823.htm (accessed 8 March 2015)

[xxiv] Transreporter, “Manzhouli Railway Container Traffic up 6% to 71,106 TEU in 2013”, 30 January 2014. http://www.transreporter.com/logisticsnews/22553/Manzhouli-railway-container-traffic-up-6%25-to-71%2C106-TEU-in-2013/ (accessed 8 March 2015)

[xxv] Suifenhe Hengda Economic and Trade Co., “Suifenhe railway port import and export volumes exceed 8 million tons”, 25 November 2013. http://en.hljhengda.com/news_detail/newsId=a5bc0088-1f2d-4a31-b4e5-b6fb3fd18f8d.html (accessed 8 March 2015)

[xxvi] Jiaoe Wang, et al.

[xxvii] National Bureau of Statistics of China, Total Consumption of Energy and its Composition, China Statistical Yearbook 2014, , http://www.stats.gov.cn/tjsj/ndsj/2014/indexeh.htm (accessed 10 March 2015)

[xxviii] Bloomberg News, “Record Oil Imports Take China Closest Ever to Passing U.S.”, 14 Jan 2015 http://www.bloomberg.com/news/articles/2015-01-14/record-oil-imports-take-china-closest-ever-to-passing-u-s-1- (accessed 11 March 2015)

[xxix] US Energy Information Agency, “China Overview”. http://www.eia.gov/countries/cab.cfm?fips=ch (accessed 11 March 2015)

[xxx] Platts Jet Fuel, “Jet: Asia glutted as China backs out imports”, March 10, 2015 (accessed on 13 March at http://www.platts.com/jetfuel )

[xxxi] Bloomberg News, “China ‘Teapot’ Refineries May Access Imported Oil Under New Rule”, 16 Feb 2015. http://www.bloomberg.com/news/articles/2015-02-16/china-teapot-refineries-may-access-imported-oil-under-new-rule) (accessed 15 March 2015)

[xxxii] “An Industry in the Re-Making: ICIS China Petroleum Annual Report”, ICIS, February 2015. http://www.icis.com/press-releases/preview-the-china-petroleum-report/ (accessed 15 MAR 15)

[xxxiii] National Bureau of Statistics of China. Volume of traded freight in China’s main coastal ports from 2000 to 2013 (in billion metric tons). http://www.statista.com/statistics/278453/trade-volume-in-chinese-coastal-ports/ (accessed April 03, 2015).

[xxxiv] China Daily, “Report reveals strong annual Shanghai shipping figures”, 20 OCT 14

http://usa.chinadaily.com.cn/epaper/2014-10/20/content_18770710.htm, (accessed 16 March 2015)

[xxxv] Reuters, “China’s Dec Russian crude imports hit record as prices fall”, Jan 22, 2015. http://www.reuters.com/article/2015/01/23/china-russia-crude-idUSL4N0V21WD20150123 (accessed 16 March 2015)

[xxxvi] Tse, Pui-Kwan, The Mineral Industry of China, US Geological Survey, Department of the Interior, Washington DC 2012. http://minerals.usgs.gov/minerals/pubs/country/2010/myb3-2010-ch.pdf (accessed 16 March 2015)